Advance Tax Planning (ATP)

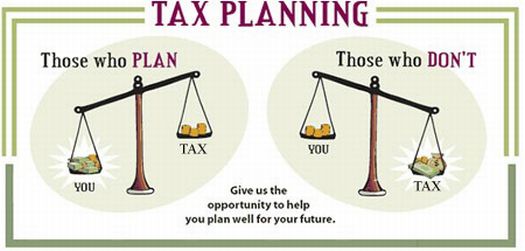

Tax Planning is an activity conducted by the tax payer to reduce the tax liable upon him/her by making maximum use of all available deductions, allowances, exclusions, etc. feasible under law. In other words, it is the analysis of a financial situation from the taxation point of view. The objective behind tax planning is insurance of tax efficiency. Tax planning allows all elements of the financial plan to function in sync to deliver maximum tax efficiency. Tax planning is critical for budgetary efficiency. A reduced tax liability and maximized the ability of retirement plans. .

.png)